Whether you are renting, owning, or living in a home, there are several insurance policies you need to be aware of. These include Liability, Auto, and Homeowners policies.

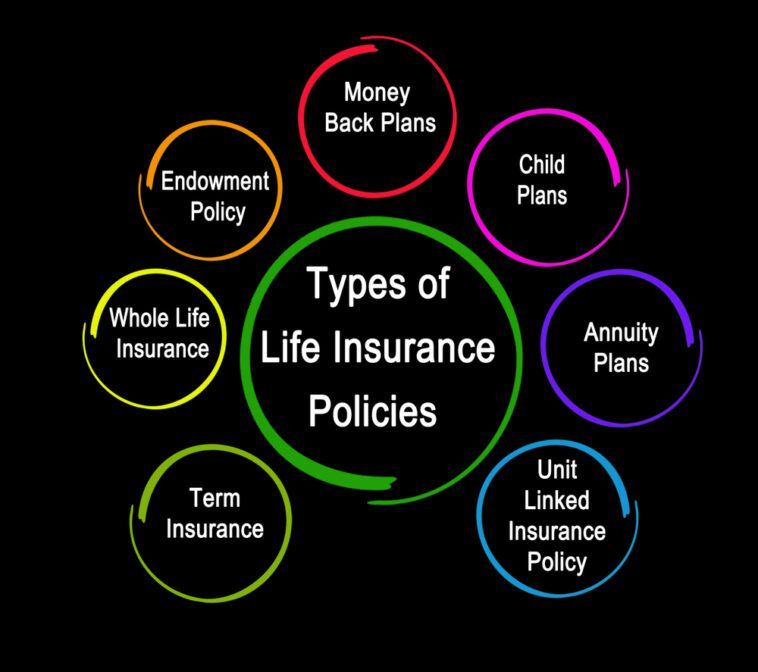

Life insurance

Whether you are married, single, or divorced, life insurance is a way to ensure that your family has financial security in case you die. It can help pay for funeral costs, taxes, or bills. Having a life insurance policy can also protect your family from unexpected medical expenses.

Purchasing life insurance can be a major commitment. It’s important to do your homework before making a decision. You will want to find an insurance agent or financial advisor who can help you understand the options available and how to select the best policy for your needs.

When purchasing life insurance, you will have to submit medical records and an application. You may also need to have a medical exam. If you are under the age of 65, you may be able to get a simplified issue policy. A simplified issue policy does not require a medical exam.

The cost of life insurance will vary depending on the age and health of the policyholder. In general, younger people pay less for life insurance.

If you have a preexisting condition, some insurers may deny you coverage. This is particularly true when you are in the contestability period. You will need to review your policy carefully to determine what risks are covered and how much you will be paid.

You may be able to get insurance through your employer or a group you belong to. Group policies typically offer fairly affordable premiums. They may also offer a grace period for your premiums. If you do not make a payment in this period, your insurance policy may lapse. If this happens, you will need to pay all of your premiums plus interest.

When choosing a life insurance policy, you should look for a company with a good track record. If you have a major life event, such as a divorce, remarriage, or birth of a child, you should update your insurance coverage. You may also need to make a change in the beneficiaries named on your policy.

Homeowners insurance

Buying homeowners insurance is a great way to protect your investment. Although it’s not legally required, many mortgage companies require you to have it. It also provides a sense of security and peace of mind.

Homeowners insurance policies cover property damage, financial losses, and personal liability. They typically cover your home, personal belongings, and other structures on your property. In addition, many policies cover vandalism and theft.

The best way to determine how much coverage you need is to take an inventory of your personal items. You can also contact a local agent or insurance broker to help you choose the coverage that best suits your needs.

Homeowners insurance isn’t necessarily cheap, but it can be well worth the investment. It helps you replace lost or damaged items, and provides temporary living expenses if your home becomes unlivable due to a covered loss.

One of the most important things to consider when buying homeowners insurance is the coverage amount. The insurer will take into account several factors when calculating your premium, including your credit, claim history, and the risk of a claim.

Some policies cover natural disasters such as tornadoes, floods, and earthquakes. In addition to a standard policy, you may also want to consider buying an umbrella policy or a personal umbrella policy.

Another thing to consider is deductibles. A deductible is the amount of money you’ll need to pay before your insurance policy starts to pay out. If your deductible is high, you may have to pay for minor repairs out of pocket.

Homeowners insurance can also cover injuries you or your family members may have sustained while on your property. Personal liability coverage can also pay medical bills, legal expenses, and lost wages if you’re sued.

Renters insurance

Generally speaking, renters insurance will cover damages or losses to your property that occur at your place of residence. It will also cover the cost of alternative living arrangements if your home becomes unlivable. However, it does not cover damages to buildings, motorized vehicles, or rooms occupied by family members.

Your renters insurance policy is also likely to provide coverage for medical expenses and liability claims. The amount of coverage will vary depending on the amount of coverage purchased. Most policies will provide $100,000 of liability protection.

If your policy includes total loss coverage, you will be repaid in full for the loss. Some policies will also provide living expenses for a certain duration of time.

Personal property coverage can help you replace stolen or damaged items. Your policy may also cover damage to items that occur in a fire or other disaster. Depending on the amount of coverage purchased, you may be reimbursed for the cost of replacing items.

Personal property coverage can also cover items stolen from outside the home. If your home is damaged by a fire, your renters insurance provider may cover the costs of replacing your valuable belongings.

Renters insurance also protects you against negligence lawsuits. Your insurer will pay for the legal costs of defending you against claims.

Your policy will also cover medical expenses and temporary living expenses. This includes meals, lodging, laundry, and other expenses. Some policies cover the cost of traveling to a hotel if your home becomes unlivable.

If your renters insurance policy includes personal property coverage, it will cover items like jewelry, art, and musical instruments. The limit for each item is typically between $2,500 and $3,000.

If you need more than this, you may purchase a special personal property coverage endorsement to increase your coverage. This will extend your personal property coverage to cover things like diamond rings. The cost of this endorsement will increase your premium.

Auto insurance

Buying auto insurance policies is a legal contract between the policyholder and the insurance company. This agreement outlines the coverages and limits that the insurance company will pay.

There are many different factors that go into determining the cost of an auto insurance policy. This can include the model, year and territory of the vehicle. There are also discounts that can be applied to the policy. These discounts will affect the amount of coverage that is covered.

One of the most common discounts is a good driving record. If you have a good driving record, the insurance company will typically give you a discount on your premium. This discount can be up to 15%.

Another discount that is often offered is a mature driver credit. This is available to people who are over 50.

The minimum excesses for insurance policies vary by insurance company. The deductible for a claim can also affect the cost of your premium. If you raise the deductible, you will pay more to make a claim.

The general insuring agreement is another thing to look for. This is a contract between the insurance company and the insured that lists the risks covered, the exclusions and the definitions. It should also list the various options available.

The best way to find the right coverage is to shop around. This will help you to find the best policy for you and your vehicle.

You may be able to save money on your premium by combining your insurance with another company. Contact the insurance company to learn more about this option.

Another good option for protecting your vehicle is auto repair insurance. This type of coverage protects you from costly breakdowns that are not related to an accident.

Liability insurance

Generally speaking, liability insurance policies protect individuals and businesses from third-party claims. These policies usually cover property damage, personal injuries, and legal costs. They may also cover other liabilities. In addition, liability insurance may be required by local laws.

A liability policy may also refer to an “occurrence.” An occurrence is a particular event or set of events that causes injury to a third party. Examples include a car accident or explosion. The insurer pays for all of the damages caused in one “occurrence.”

A liability policy may also provide coverage for a business’ employees. Many policies also include coverage for employees’ relatives. Liability insurance is often required for those who practice medicine, make products, or work in automotive, real estate, or construction.

Product liability insurance is another form of liability coverage. This policy protects a business from lawsuits that arise from injuries or property damage caused by its products. Products include chemicals, industrial machinery, electrical and mechanical products, food, and beverages.

In the US, liability insurance is the largest insurance market. In 2013, US businesses paid USD 84 billion for liability covers. They also spent USD 9.5 billion on medical malpractice.

The United Kingdom is the second largest liability insurance market in the world. In 2013, UK liability insurance premiums generated USD 9.9 billion. The market is highly dependent on local conditions. Its penetration of liability insurance is 0.32% of GDP.

In Europe, liability insurance is dominated by the markets in continental Europe. These markets are primarily governed by civil law systems and historical experience. The markets vary between 0.16% and 0.25% of GDP.

There are a number of sub-segments in the liability insurance market. The largest is public and product liability. The second is professional indemnity.